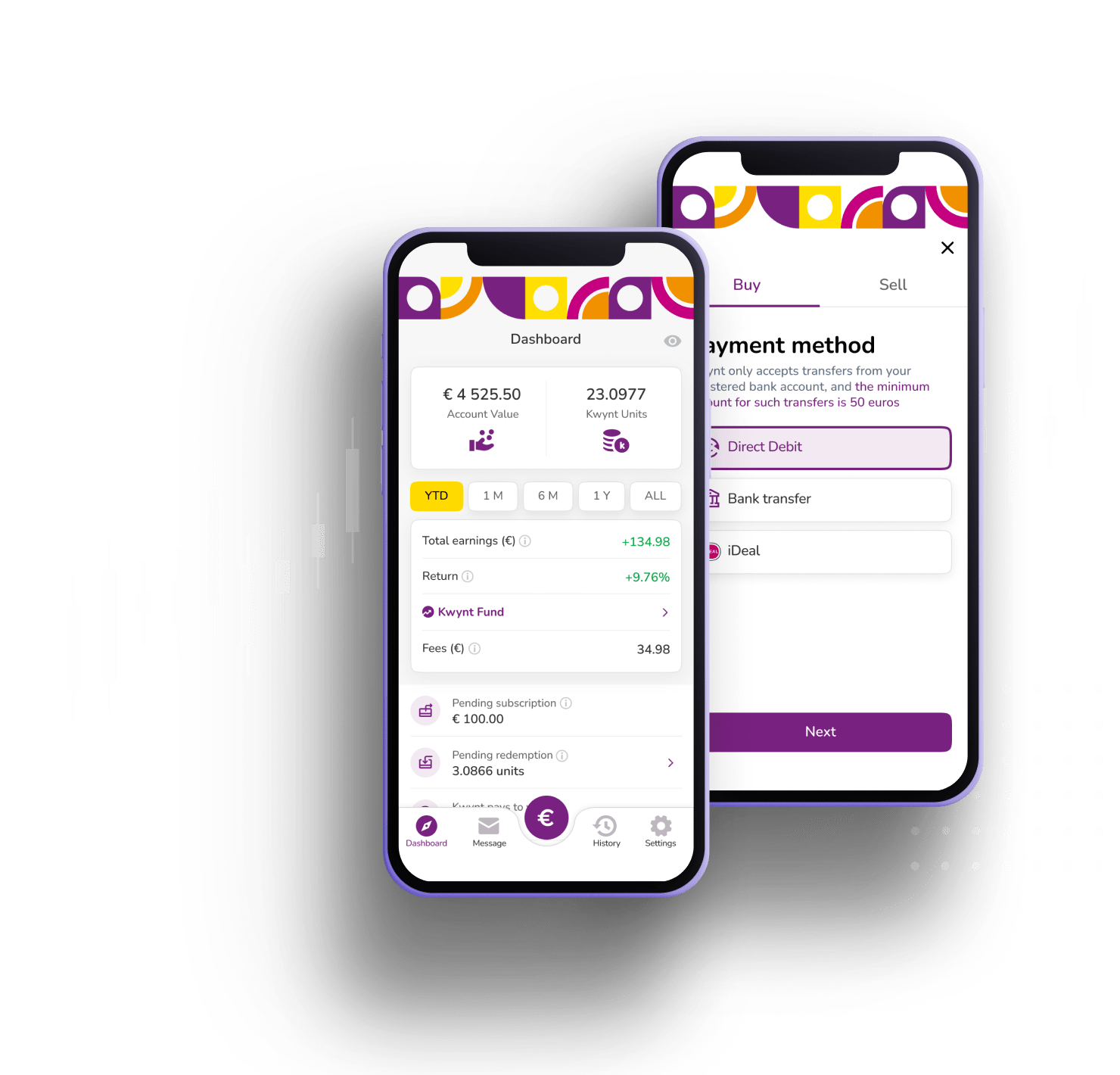

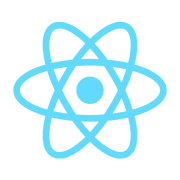

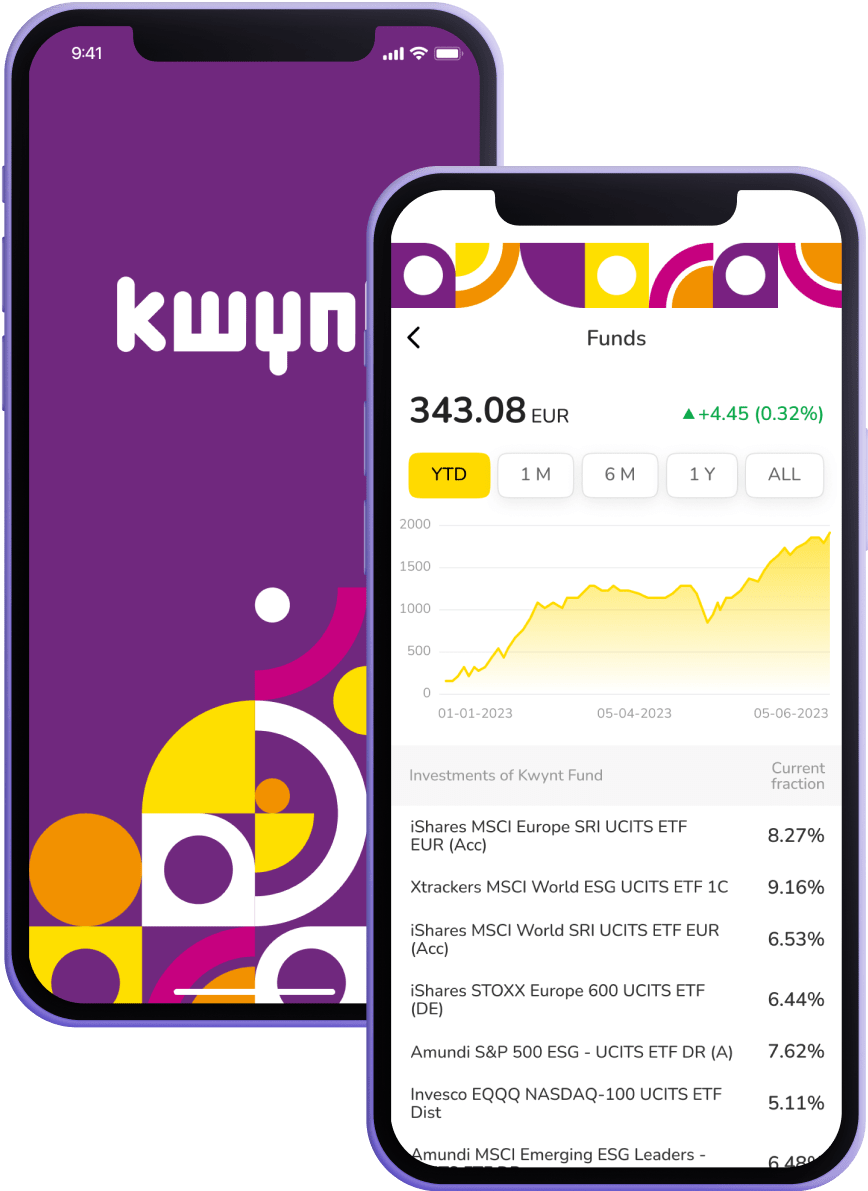

App & web platform for a fintech with real-time investment on capital markets.

About the project

Kwynt is a fintech company that aims to revolutionize investment. Through legal and financial innovation, it allows everyone to invest passively and without fees on the capital markets.

Sector

Fintech

Type

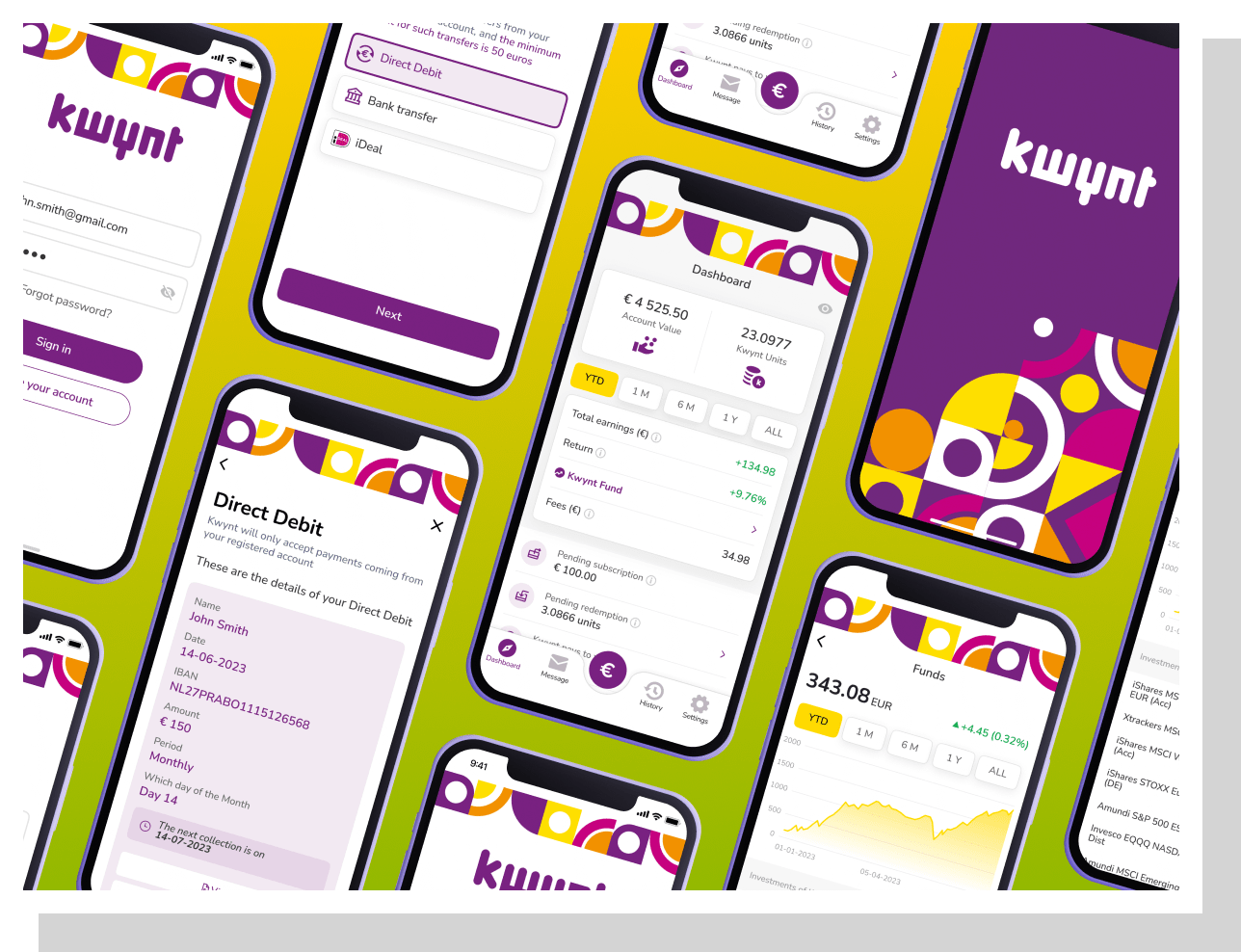

Mobile app

Web app

Admin platform

Zetos services

Dynamic collaboration and design thinking workshops to define essential functionalities.

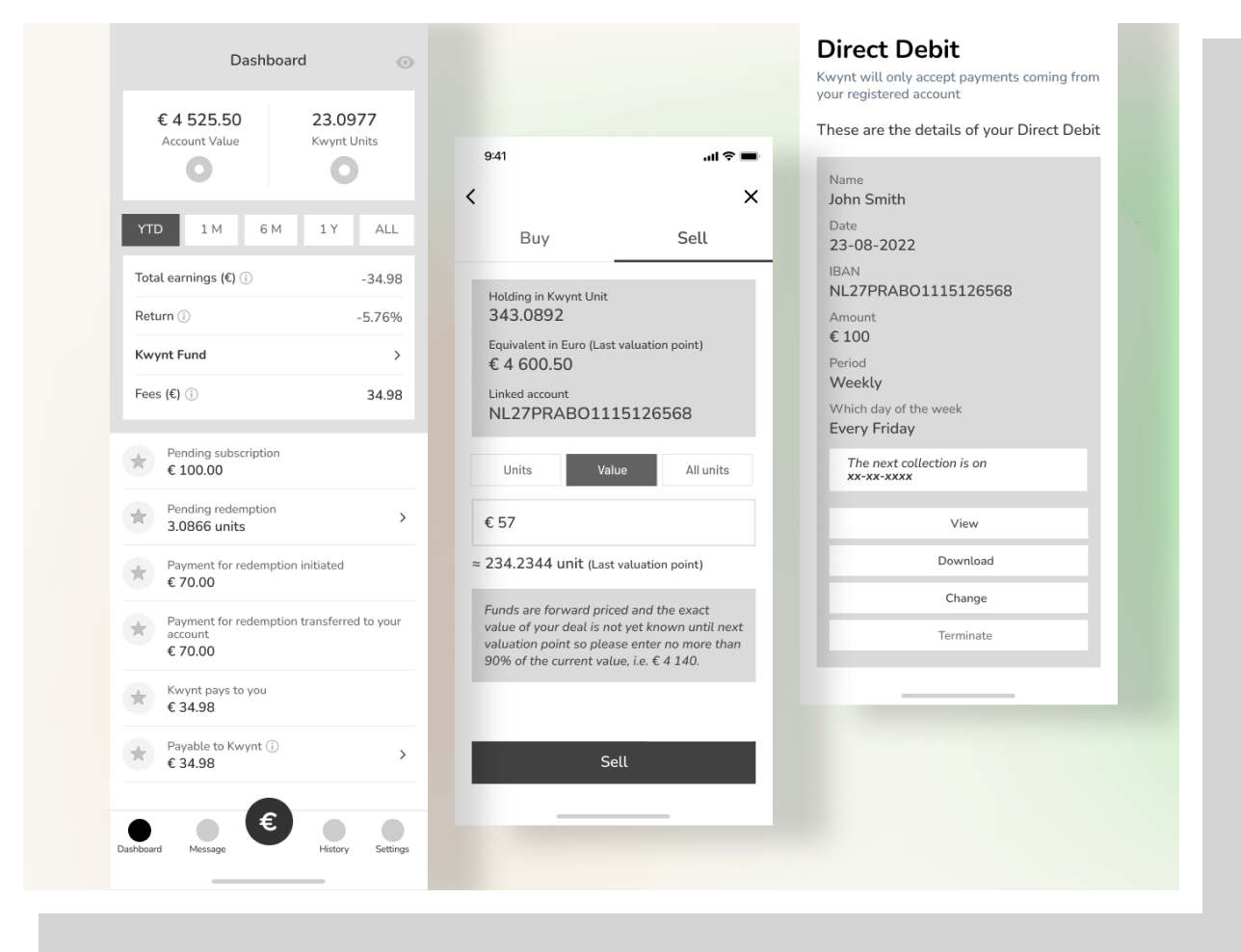

Definition of specifications and technical specifications for the first version of the product. Concept validations through individual interviews using models created on figma.

Definition of specifications and technical specifications for the first version of the product. Concept validations through individual interviews using models created on figma.

Graphic design of the visual identity and creation of complete mockups of the application, always on figma to allow for back and forth, and based on the initial mockups

Development in bi-monthly cycles to ensure monitoring and progress of the project. Test phases in a pre-production environment, followed by production launch after validation of the cycle. Demonstrations and acceptance testing with the client to guarantee an optimal result.

Tech stack

The Kwynt backend is coded in Java + MySQL. The mobile application is based on AWS Cloud.

Cloud

AWS

Front End

React

Android

Java

iOS

Object C

Database

MySQL

Backend

Java

Queue & performance

Redis

Our favorite features

Direct investment without

intermediaries and without fees

intermediaries and without fees

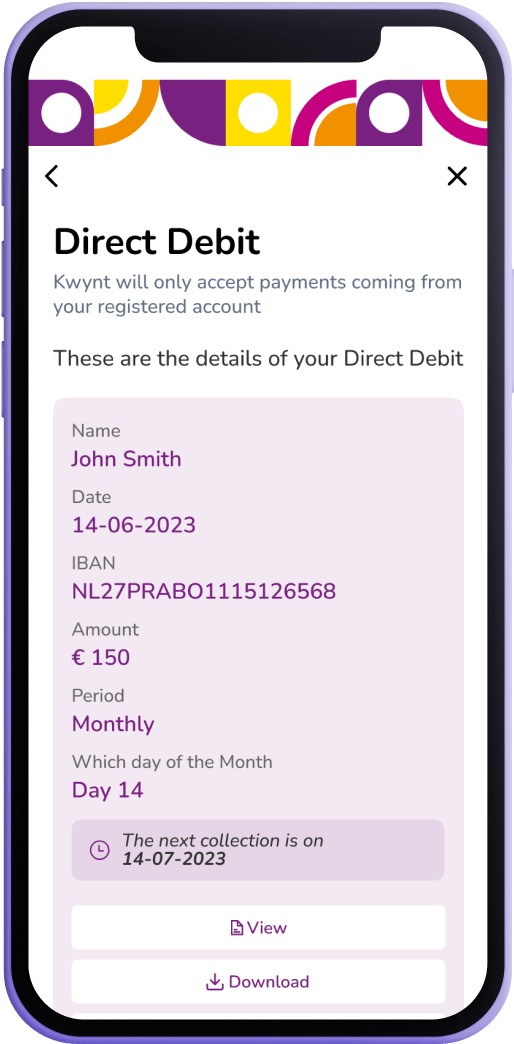

Thanks to an advanced KYC system and an interconnection with the banking and financial system, Kwynt users can place orders directly to acquire Kwynt Units, which represent a part of the global economy, all without any fees. This allows small investors to regularly invest amounts from €50 without being overwhelmed by execution fees.

The admin dashboard

Connected live to the mobile and web application, this dashboard allows you to easily monitor the use of the platform. It also allows you to manage the entire back office (settlement, order book, execution, disputes, etc.)

Passive investment

By establishing a direct connection between Kwynt, the user's bank account and the iDeal payment system (Netherlands), we enable users to invest passively and regularly.

The project in figures

GDPR the first

platform automating

KYC and AML being

GDPR

platform automating

KYC and AML being

GDPR

Automatisation of KYC,

AML as well as ETF settlement

AML as well as ETF settlement

1M users in max

capacity

capacity